|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Refinance Home Loan After Bankruptcy: Opportunities and ChallengesRefinancing a home loan after bankruptcy can seem daunting, but it is not impossible. Understanding the process, benefits, and drawbacks can help you make informed decisions. Understanding the Refinancing ProcessAfter bankruptcy, refinancing your home loan requires careful consideration and planning. The process involves replacing your existing mortgage with a new one, potentially with better terms. Eligibility CriteriaTo refinance, you must meet certain eligibility requirements, which often include a waiting period after bankruptcy discharge. Typical waiting periods vary depending on the type of bankruptcy and loan. Credit Score ConsiderationsYour credit score is a crucial factor in refinancing. Post-bankruptcy, improving your credit score should be a priority. Lenders usually look for a score of at least 620, though some options may exist for those with lower scores. Pros of Refinancing Post-Bankruptcy

For the most up-to-date rates, you can explore current refinance rates utah. Cons of Refinancing Post-Bankruptcy

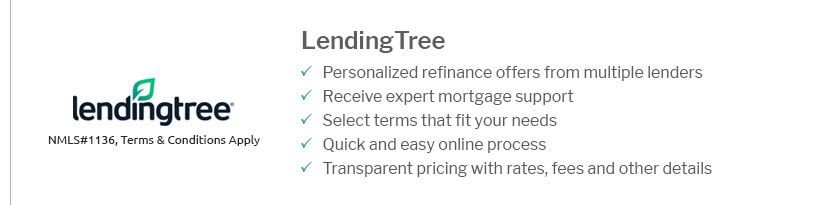

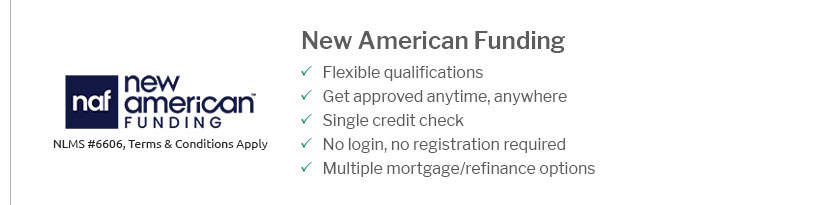

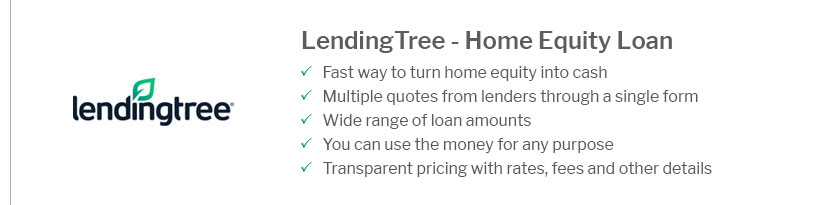

Exploring Lender OptionsChoosing the right lender is critical. Some lenders specialize in post-bankruptcy refinancing and might offer more favorable terms. Consider looking into fha streamline refinance lenders for potential opportunities, especially if you have an FHA loan. FAQHow long after bankruptcy can I refinance my home?Typically, you must wait 2 to 4 years after a bankruptcy discharge, depending on the loan type and lender requirements. Will refinancing affect my credit score?Refinancing can temporarily affect your credit score due to hard inquiries, but timely payments on the new loan can improve your score over time. https://www.peoplesbankmtg.com/news/can-i-get-a-home-loan-after-bankruptcy/

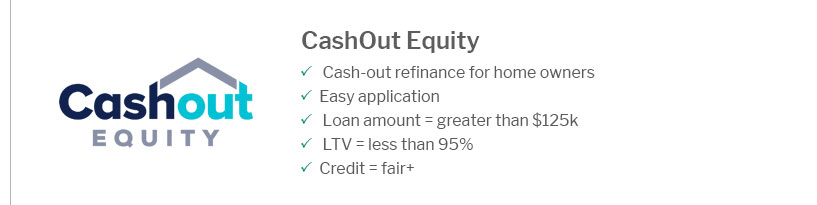

You may be able to obtain a cash-out refinance home loan as soon as you are discharged from a Chapter 13 bankruptcy. However, it is important to do your best to ... https://www.jvmlending.com/blog/non-qm-mortgages-after-bankruptcy/

This strategy essentially clears the bankruptcy, allowing you to consolidate all outstanding obligations into a single mortgage loan. It also ... https://money.usnews.com/loans/mortgages/articles/how-long-after-bankruptcy-can-you-refinance

If you filed for Chapter 7 bankruptcy protection, you must wait at least two years from the discharge date before you can refinance your VA loan ...

|

|---|